Looking for the best loan apps in Nigeria for fast & seamless loan processes? You’re in the right place. In reviewing the best personal and business loan apps in Nigeria, our team researched all the current online loan apps in Nigeria, reviewed their features, and formed our own original thoughts about each. It should be noted that all these loan apps are legit loan apps.

1. Palmcredit

Palmcredit is a digital lending platform in Nigeria that offers quick loans to individuals and small businesses. It is the best loan app in Nigeria. The platform can be accessed through its mobile app, allowing users to borrow up to NGN 100,000 without collateral.

To apply for a loan, users must first download the Palmcredit app, complete the registration process, and apply for a loan. Approval and disbursement of loans are typically done within a short period.

The interest rate for Palmcredit loans ranges from 14% to 24%, with loan terms ranging from 14 days to 180 days. Palmcredit also offers instant loan online but it depends on the individual.

Repayment of loans can be made through the app or bank transfer, and Palmcredit has a customer service hotline available for questions and complaints. Also, Palmcredit gives reward offers for referring people to Palm Credit.

The parent company, Newedge Finance Limited, is fully licensed by the Central Bank of Nigeria to operate as a finance company.

How to Borrow Money From Palmcredit

- Download the Palmcredit App

- Fill out the registration form displayed on the app, verify your phone number through the code sent to you, and complete the verification process. Kindly note that if you already have a Palmcredit login details, all you have to do is login.

- Choose the amount and duration of the loan you wish to apply for.

- After submitting your loan application, wait for it to be processed and approved.

- Loan will be disbursed into your account.

Pros

- It gives rewards for referrals

- Loan application is fast and easy

Cons

- The interest rate seems a bit too high.

- It is not available on AppStore

4.2⭐/175k reviews

2. FairMoney

Fairmoney is a popular loan app in Nigeria known for its fast disbursement of loans, which can be completed in just five minutes. If you need a loan urgently, Fairmoney is the app for you.

These loans’ annual percentage rate (APR) ranges from 30% to 260%, with a monthly interest rate of 2.5% to 30%. These competitive rates make Fairmoney a top choice for individuals seeking low-interest loans.

Fairmoney is highly regarded as one of Nigeria’s top loan apps, partly due to its minimal document requirements and lack of loan collateral. These factors make it a convenient and accessible option for borrowers. Asides from offering personal loans, Fairmoney also offer business loans to small and medium-sized enterprises. The maximum loan offer for businesses is 5 million Naira.

To apply for a loan from Fairmoney, you must have the Fairmoney app and an account with them. You also need a valid Bank Verification Number (BVN) and correct bank details, a valid mobile number, and the phone numbers of two guarantors. These requirements must be met to apply for a loan from Fairmoney successfully.

You can receive your funds without providing collateral and pay them back within 15 days or one month. The process is straightforward.

Some specific terms and restrictions will be associated with the loan, so read them before applying.

FairMoney also allows you to spread your repayments over multiple instalments to have more flexibility, making the app and services much more accessible. Paying your loan on time allows you to get more benefits.

How to Borrow From Fairmoney

- Fairmoney app download

- Register on the app by providing personal information like your name, BVN, phone number, and next of kin.

- Fairmoney will offer you a loan.

- Tap receive Loan Offer

- Accept the loan offer, and your funds will be released to your account immediately or within 15 minutes.

Pros

- Easy way to get a loan

- Your loan amount increases as you pay early

Cons

- The interest rate is too high.

3.1⭐/593k reviews

Download on Playstore

Download the Fairmoney App on AppStore

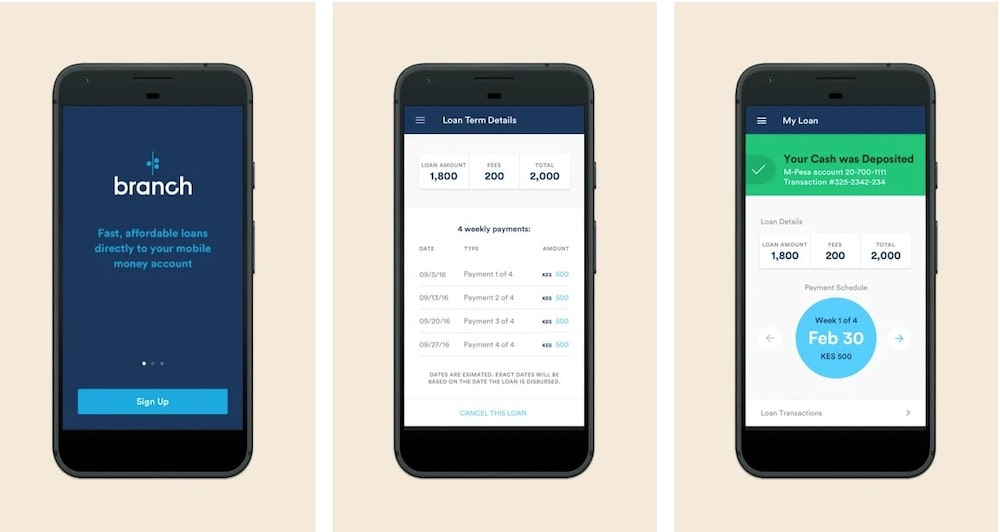

3. Branch

Branch is a mobile loan app that is easy to use and quick. It is available in Nigeria and Kenya. With Branch, you can quickly and easily get instant loans to help you resolve your financial issues in real time.

Branch is a trusted loan app in Nigeria known for its competitive monthly interest rates of 1.5% to 20%. Its APR of 18% to 260% is lower than that of many other popular mobile loan apps, including Fairmoney, Carbon, and Palmcredit, making it a the best loan app in nigeria with low interest. Branch also gives loan with bvn only.

Like the other loan apps described above, Branch does not demand any collateral to obtain loans. You will need your phone number, Facebook account, bank verification number, and account information to apply for a loan. That’s all you need to get started.

The Branch loan app allows you to borrow from #1,000 to #200,000 at competitive interest rates. The app offers a convenient and accessible way to get financial support.

One of the standout features of the Branch app is its ability to offer more significant loan amounts as you build credit with them. Once approved for a loan, the money is disbursed and repaid directly through the app, making the process convenient and efficient.

Another advantage of using Branch is that they don’t charge late or rollover fees, which can add up and further strain your finances. Additionally, Branch has a reputation for providing excellent customer support, available 24/7 through the app.

Overall, Branch offers a reliable and convenient way to access loans when needed.

How to Borrow From Branch

To apply for a loan after downloading the app, follow these steps:

- Download the Branch loan app either on playstore or app store

- Create an account and complete a simple form with accurate information to avoid processing delays.

- Determine your loan eligibility and submit an application.

- Specify the bank account where you want to receive the loan.

- Expect your loan to arrive in your bank account within 24 hours.

Pros

- Easy way to get a loan

- Reasonable interest rate

Cons

- Some customers complained of app glitches.

4.6⭐/1.33M reviews

4. Aella Credit

Aella Credit is a digital lending platform in Nigeria that offers instant loans to individuals and small businesses. It was founded in late 2015 by Akin Jones, CEO, and Akanbi Wale, CTO, in Lagos.

It offers loans to individuals and companies, focusing on granting credit access to those who are unbanked and underbanked. Aella Credit stayed committed to building trustworthy credit facilities for emerging markets, with the main focus on Nigeria and the Philippines.

Aella Credit is also one of the list of loan apps approved by CBN. This loan app gives credit loans to individuals either for personal use or business purposes within five minutes.

With Aella Credit, you can apply for loans ranging from N2,000 to N1,000,000, with repayment periods of up to 3 months. The platform boasts competitive interest rates ranging from 6% to 20%, with no late or rollover fees.

To increase your chances of qualifying for higher loan amounts and more favourable interest rates, it is essential to make prompt repayments to build your credit score. Aella Credit is available through their mobile app, which can be downloaded from the Google Play store.

How to Borrow From Aella

- Download and install the Aella Credit app.

- Create an account

- Verify your Phone number and email

- Apply for a loan

- Wait for the approval of your loan.

- Receive your funds in your bank account.

Pros

- Easy way to get a loan

Cons

- Starting loan amount is a bit low.

3.2⭐/35k reviews

Download on Playstore

5. Easemoni

Easemoni is a Nigerian loan service provider that allows customers to apply for instant loans through their mobile app.

The app allows users to apply for loans without collateral and can receive their loan within 10 minutes of applying. Easemoni offers loans of up to N1,000,000 to both new and existing users, with the ability to increase their credit score by frequently using the app and paying back loans on time.

To register for Easemoni, users must download and install the mobile app, enter their basic details, and apply for a loan.

The interest rate for loans on Easemoni ranges from 5% to 10% per month, with a loan tenure of 91 to 365 days. To be eligible for a loan on Easemoni, customers must be Nigerian citizens, be within the age range of 20 to 55 years, have a good source of income, and provide valid personal information.

How to Borrow From Easimoni

- Go to the Easimoni website or download the app and click on the “Apply Now” button

- You will be prompted to create an account by providing your personal information

- Fill out the loan application form

- Wait a few minutes for approval

- Easimoni will send you a loan offer

- If you are satisfied with the loan offer, you can accept it by providing your electronic signature.

- After you have accepted the loan offer, Easimoni will disburse the funds to your bank account.

- Then You will be required to repay the loan according to the agreed-upon terms

Pros

- It offers quick and easy approval.

- It has a good and flexible repayment plan.

Cons

- The loan is not for everyone but for only Opay users

4.5⭐/223k reviews

6. Carbon

Carbon is a digital banking platform based in Lagos, Nigeria that offers users financial services, including access to loans, convenient payment solutions, and high-yield investment opportunities. Carbon was previously known as PayLater.

This convenient online lending platform offers short-term loans to meet unexpected expenses or urgent cash needs. The process is simple and easy to use.

Carbon is an online lending platform that provides short-term loans to help with unexpected expenses or urgent cash needs. The Carbon loan app allows you to borrow more than 500k loan in 5 minutes, with no collateral required. You only need a smartphone and an active bank account in Nigeria to get started. Carbon’s service is available 24/7 and is open to everyone, regardless of occupation or background.

To apply for a loan through the Carbon app, you must complete the mandatory Know Your Customer (KYC) process, which includes your name, phone number, address, and other basic personal information. You must also provide a bank verification number (BVN), bank account details, and a government-issued identification card.

Carbon’s interest rates range from 5% to 15% based on the amount financed and the repayment duration. As you borrow and repay on time, Carbon may offer you lower interest rates on future loans.

Repaying your Carbon loan is easy and can be done through the app. Log in and select the “Repay Loan” option. You can also provide a credit card as a repayment method if desired. The Central Bank of Nigeria fully licenses carbon and is expanding to become a mobile money operator, allowing you to save, withdraw, and transfer money within Nigeria.

Applying for a Carbon Loan

- Download the Carbon app from either Playstore or Appstore.

- Register and provide your name, phone number, and email.

- Take a real-time photo using the Carbon app.

- After registering, you’ll receive a personal account number.

- Tap “Request a Loan” on your dashboard and complete the required information.

- Carbon will review and approve your application within an hour, disbursing the loan into your personal account.

Pros

- Loan application is simple and fast

- The loan limit is up to 1 million naira

Cons

- The interest rate on the app is high.

4.3⭐/161k reviews

Download on playstore

Download on AppStore

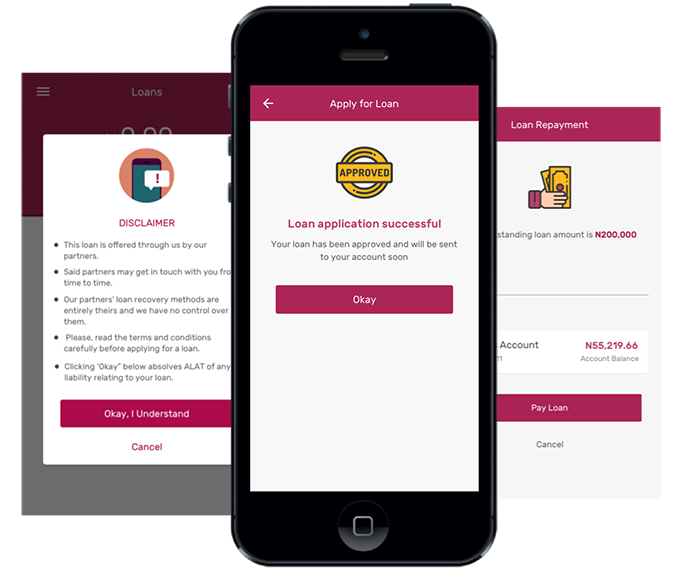

7. ALAT Loan

Alat is a digital bank in Nigeria that Wema Bank owns. Alat users can access various financial services such as loans, savings, transfers, payments, and physical and virtual cards.

The platform offers loans up to N2,000,000 Naira with an interest rate of 2% per month on a reducing balance basis.

One of the advantages of Alat loans is that they do not require collateral, paperwork, or documentation and can be easily applied for and obtained through the Alat app. Applying for a loan and receiving the funds should take only 5 minutes.

It has different types of loans, including salary-based loans, goal-based loans, and device loans. To qualify for an Alat loan, you must have an Alat standard savings account, an upgraded profile, and a history of credit and debit transactions on your Alat account.

How to Apply for an ALAT Loan

Here are the steps to apply for a loan on ALAT after downloading the app :

- Download and install the loan app

- Create an account on the app

- Verify your phone number.

- From the menu list, select “Loans.”

- Review the ALAT app’s disclaimer page for any additional information.

- Loan offers are made after a successful credit check and review.

- By accepting the loan, you agree to repay it on the due date as outlined in ALAT’s terms and conditions.

- Submit your information and loan request.

- Your loan will be deposited into your bank account within five minutes.

- Make timely payments to increase your credit limit.

Pros

- It is safe, efficient, and confidential.

- It has low-interest rates.

- It has flexible repayment plans.

Cons

- It is only available to customers with ALAT standard savings accounts.

- Applying for a loan is not instant

3.9⭐/37.8k reviews

Top 20 Loan apps in Nigeria

| Loan App | Rating | Download | Pros | Cons |

| Palmcredit | 4,2 | Download on PlayStore | Gives rewards for referrals | Not available on AppStore |

| FairMoney | 3.1 | Download on Playstore Download on AppStore | Your loan amount increases as you pay early | The interest rate is too high. |

| Branch | 4.6 | Download on Playstore | Reasonable interest rate | Some customers complained of app glitches. |

| Aella Credit | 3.2 | Download on Playstore Download on Appstore | Easy way to get a loan | Starting loan amount is a bit low. |

| Kiakia | 3.1 | Download on Playstore | Loan application is simple and fast. | The interest rate is too high |

| Carbon | 4.3 | Download on Playstore Download on AppStore | loan limit is up to 1 million naira | Interest rate on the app is high. |

| ALAT Loan | 3.9 | Download on Appstore | low-interest rates | Applying for a loan is not instant |

| SokoLoan | 3.7 | Download on Playstore | Easy loan application | Interest rates are high |

| QuickCheck | 3.7 | Download on Playstore Download on AppStore | Gives low offers for new offers | Your loan is disbursed almost immediately |

| RenMoney | 4.0 | Download on Playstore Download on AppStore | Good customer service | Interest rate varies. |

| Zedvance | 3.7 | Download on Appstore Download on Playstore | High loan amounts, unlike other apps | Application procedure is difficult and takes a lot of time. |

| Quickteller | 3.7 | Download on Playstore | Application procedure is fast and easy to fill | Repayment time is short. |

| JumiaOne | 3.5 | Download on playstore | No guarantor or collateral requirements | Loan offers are low. |

| VULTe | 2.8 | Download on Appstore | No collateral or paperwork is required | The maximum loan offer is low. |

| Easemoni | 4.5 | Download on Playstore | Offers quick and easy approval. | loan is not for everyone but for only Opay users |

| Lidya loan | 3.6 | Download on Playstore | Offers flexible loan terms, including up to 12 months repayment periods | Limited number of businesses that can access its services. |

| LendMe | 3.6 | Download on Playstore | Fast approval process and funding time | High-interest rate. |

| Kredi | 4.0 | Download on Playstore | Offers flexible repayment options | Offers loans up to a certain limit. |

| CreditVille | 3.1 | Download on Playstore | Repaying a loan is easy and convenient. | Has a bad locator |

Conclusion

There are pros and cons to taking out a loan online in Nigeria. One of the main benefits is that the process is fast and straightforward, as there is no need to visit a lender’s office in person. In addition, online loans offer more flexibility and convenience, with the ability to compare loan terms and potentially receive the loan disbursement within the same day.

However, how certain information is presented and interpreted can be unclear, and hidden fees may exist. There is also a need for more human contact, which can be a drawback if clarification is needed on the fine print.

It is important to be aware of predatory lenders who may take extreme measures to collect on the loan if it is not repaid on time. Overall, it is important to carefully consider the pros and cons of taking out a loan online and choosing a reputable lender.