The Piggyvest app is a mobile savings app that allows users to save and invest small amounts of money regularly. This used to be the domain of banks. However, with the rise of fintech, a new generation of mobile-first companies is disrupting this space and making financial services more accessible through easy-to-use apps.

As a single app for savings and investment, Piggyvest has helped over 3 million customers achieve their financial goals since launching in 2016. With features like multiple savings plans offering interest rates up to 13% per year and a new investment option called Investify, Piggyvest gives users powerful tools to build wealth.

In this Piggyvest app review, we will explore all the platform offers. We’ll examine its various savings plans, interest rates, investment products and overall user experience. For anyone looking to take control of their finances and start saving or investing with simplicity, this review will help you understand if Piggyvest is the right choice.

At the end of this article, you’ll know all about Piggyvest’s services and benefits and be able to decide if it can help you transform your financial journey.

What is Piggyvest All About?

Piggyvest is an online savings and investment platform that allows users in Nigeria to manage their finances efficiently. Launched in 2016, Piggyvest was originally called Piggybank but later rebranded to Piggyvest in January 2017 after expanding to offer investment services and savings.

Piggyvest was founded by Odunayo Eweniyi, Somto Ifezue and Joshua Chibueze, who saw the need for a digital solution to make saving and investing more accessible and convenient for Nigerians. Since its inception, the platform has grown to over 350,000 users who can save billions of Naira monthly through Piggyvest’s intuitive app.

Piggyvest also has a subsidiary app called the Pocket app. It is fully licensed by the Central Bank of Nigeria (CBN) under Abeg Technologies, and your deposits are insured by the Nigeria Deposit Insurance Corporation (NDIC), ensuring the safety of your funds.

How to Use Piggyvest

With over 350,000 users, Piggyvest allows you to automate savings, invest funds safely and earn competitive returns. Setting up an account only takes a few minutes.

- Download the Piggyvest app on Appstore or Playstore or visit piggyvest.com

- Register with your phone number and set a password

- Verify your identity by uploading a valid ID

- Fund your account starting from ₦1,000 by linking your bank or using a debit card.

- Choose a savings plan like Piggybank or Target Savings, or invest from ₦1,000 with Investify.

Your Piggyvest account is ready to use via the app. Automate savings and monitor progress towards your financial goals. If you have opened your account, you will be rewarded 1000 naira as a welcome bonus, which will be in your account for ten days.

How to Save Money on the Piggyvest App

With over 350 thousand users, Piggyvest has established itself as Nigeria’s leading personal finance platform. It offers a wide range of innovative features to help users take control of their money.

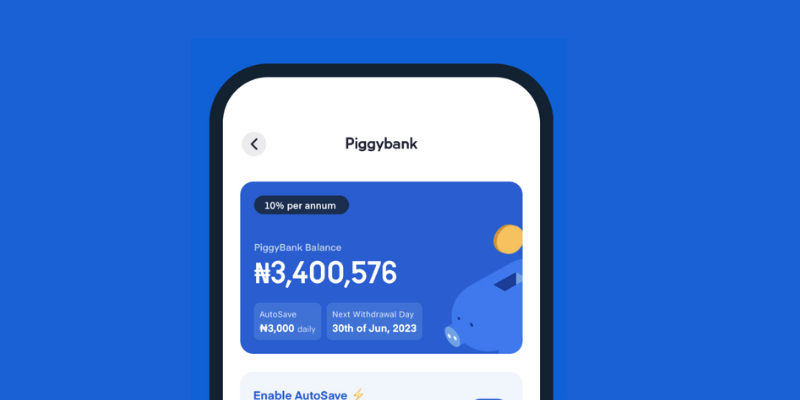

Piggybank Savings

The Piggybank is the significant savings feature offered by Piggyvest. It provides users two convenient options to automate savings – Autosave and Quick Save.

Autosave allows you to set up automatic deductions from your linked bank account on a fixed daily, weekly, or monthly schedule. Specify the amount you want to be deducted each time, and Piggyvest will debit it without any further action required. This is ideal for those who want to build a savings habit effortlessly through consistent small amounts.

For more flexibility, the Quick Save option lets you manually deposit any amount you desire at any point in time. You don’t have to stick to a fixed schedule. Use this for one-time lump sum savings or topping up your regular Autosave amounts.

With both Autosave and Quick Save, your funds are deposited into your Piggybank account. Piggyvest then pays interest on the balances at a competitive rate of up to 13% annually. This rate is higher than traditional bank savings accounts, rewarding users for utilizing the platform.

Piggyvest also offers 4 free withdrawal days annually, where you can access your savings without penalties. This provides needed liquidity while still encouraging long-term growth of funds. Withdrawals outside these days attract a minor 5% fee.

Safelock Savings

Safelock is Piggyvest’s fixed savings plan that allows users to lock away their funds for a predetermined period ranging from 10 days up to 1000 days, acting like a customized designated deposit account. This provides flexibility to suit different savings goals and risk appetites. Users can choose the days they want their funds locked, whether just over a week, a few months or nearly three years.

The funds are locked away and inaccessible until the chosen maturity date, helping users avoid spending temptation during the investment period. Once the funds are placed in Safelock, they earn a competitive interest rate of up to 15.5% per annum depending on the selected duration. These rates are substantially higher than traditional bank deposit accounts.

Safelock acts as a sub-account, so funds can be easily transferred from a user’s Piggyvest wallet or linked bank account. The minimum amount required is a low ₦1000. Interest is calculated based on the annual rate and chosen duration. Unlike fixed deposits, where interest is paid monthly or annually, Safelock pays out the total interest upon maturity for maximum return on investment.

Target Savings

Target Savings is a feature on Piggyvest that allows users to save towards specific financial goals in a focused manner. This could be goals such as saving for rent payments, an upcoming vacation, a large household purchase or other targets.

To use Target Savings, a user must first define the goal by naming it and providing a brief description. They then input the total target amount required. Users can save towards the target individually or as part of a group challenge with other Piggyvest members.

Once the target is set up, the user selects the frequency that funds will be allocated – daily, weekly or monthly deductions. Piggyvest will then withdraw the specified amount from the user’s linked bank account or wallet based on their schedule.

As the balance in the Target Savings grows with each contribution, interest is earned at a competitive rate of 10% per year. This helps the savings grow faster and ensures the target is reached sooner than regular savings alone.

Users can track their progress towards their savings goal in real-time on the Piggyvest app. If part of a group challenge, there is also a leaderboard to stay motivated. Once the target amount is hit, the funds can be withdrawn along with the earned interest.

Flex Naira

The Piggyvest Flex Naira account is a user’s primary wallet and savings account on the platform. Flex Naira works similarly to a regular bank savings account, earning 8% interest annually, which is paid out every month. Users are allowed a maximum of 4 withdrawals from their Flex Naira balance each month to receive the total monthly interest payment. However, if more than four withdrawals are made, the user will forfeit that month’s interest earnings but can still withdraw funds freely.

Flex Naira is the only Piggyvest account with a linked bank account number, allowing easy money transfers to and from a user’s external bank account. At the end of each month, any interest accrued from other Piggyvest savings plans like Target Savings and SafeLock is automatically credited into the user’s Flex Naira account.

It is also a user’s central account to manage funds across the Piggyvest platform. Money in Flex Naira can be used to deposit into other Piggyvest wallets and investment products. This provides flexibility while still earning a good return on savings through monthly interest payments. Therefore, the Flex Naira account offers users the perfect balance of accessibility, interest rewards, and overall control over the money they store on Piggyvest.

Investify

Piggyvest’s Investify platform allows users to quickly grow their savings by investing in vetted business opportunities from as low as ₦3,000. Through Investify, users can take their savings to the next level and achieve higher returns compared to regular savings accounts.

A wide range of low-risk, pre-screened investment options are available on Investify across sectors like agriculture, real estate, manufacturing and more. These investment opportunities are thoroughly researched and vetted by Piggyvest’s team to ensure only viable projects with a high likelihood of success are featured.

Investors can earn attractive returns ranging from 15-25% depending on the duration of their investment, which typically ranges from 6 months to a year. Your capital is insured for each investment, so your original funds are protected regardless of the project’s performance.

Profit payments from matured investments are automatically credited to the user’s PiggyFlex account daily, monthly, quarterly or annually based on the investment’s duration. This provides convenience as users do not need to monitor each investment.

How Does Piggyvest Investment Work

- Sign up on the app/website with basic KYC.

- Fund your account by transferring ₦3,000 minimum from your bank.

- Choose an investment plan from 30 days to 1 year with varying interest rates.

- Piggyvest invests your money in assets like bonds and T-bills.

- Earn daily compound interest as per your chosen plan.

- At maturity, the profit will automatically be credited to your Piggyflex.

- PiggyPoints & Referrals

Piggyvest rewards users for actively using the platform and inviting friends through its PiggyPoints and referrals program.PiggyPoints are loyalty points earned for activities like making deposits, achieving savings milestones, participating in challenges, etc. 10 PiggyPoints are equivalent to ₦100 cash, providing users an additional incentive to engage with Piggyvest’s features regularly.

Users can also earn referral bonuses by introducing Piggyvest to friends and family. For every successful referral that signs up and starts saving, the referrer receives 20% of whatever the referred user keeps as a bonus paid in PiggyPoints. This encourages viral growth through word-of-mouth promotion.

Piggyvest motivates users to develop positive financial habits and rewards them for helping others do the same. The ability to redeem accumulated points for cash adds more value to the engagement. The referral program also strengthens Piggyvest’s community by creating a network of users promoting the platform to their connections.

Flexi Dollars

The Piggyvest Flex Dollar account provides users a viable option for saving in US Dollars within the Piggyvest platform. This helps shield savings from the volatility of the naira relative to the dollar over time. Users can convert funds from their Naira Flex wallet to dollars using the exchange rate or deposit directly in dollars from an external bank card.

Any funds in the Flex Dollar account earn a competitive 6% annual interest. Users can withdraw dollars internationally by transferring to an offshore account or locally by first converting back to Naira, which can then be drawn to the individual’s naira wallet within the app without any charges. While withdrawing dollars directly to an external foreign bank account does attract a small fee, the ability to earn dollar interest locally while still having the option to withdraw back in naira positions the Flex Dollar account as a convenient way for Nigerians to preserve savings from naira fluctuations.

With its comprehensive suite of savings, investment, and rewards features, Piggyvest has become one of Nigeria’s top 10 fintech companies for millions looking to build wealth effortlessly over time.

Is Piggyvest Legit or Scam?

As everyone knows, there are scam websites everywhere. People fear putting their precious money in some banks, thinking they are scams or legitimate. Most people want to know if Piggyvest is a scam or legitimate.

The piggy vest is legitimate, licenced, and CBN-approved. Being a reliable business, it also collaborates and uses the licences of two microfinance banks. Piggyvest has a registration number of 16555 and is known as Piggytech Cooperative Multipurpose Society Limited.

According to research, it has been stated that customers have not said anything negative about them for the past three years since it was established. So, any transactions made through Piggyvest are safe and premium.

How to Withdraw From Piggyvest App

- Open the app and tap Savings.

- Then, tap any of the savings account

- Next, tap the withdraw button

- Fill in the amount.

- Lastly, pick your fund destination.

You can only take out money from Piggy Bank on the designated withdrawal date or adjust it to a different date that works for you.

In contrast, you must convert your funds to Naira to withdraw on Flex Dollar; the Naira will then be transferred to your Flex Naira.

Piggyvest Customer Care Contact

For any queries, support, complaints or feedback regarding your Piggyvest account or investment plans, you can reach out to their customer care team through the following channels:

- Email: [email protected]

- Phone: 0700 933 933 933

- WhatsApp: Same

- Live chat on the website

Provide full name, phone number and transaction details for account access.

Pros of Piggyvest App

- Easy-to-use interface and automation make saving simple

- Attractive interest rates of up to 13% on savings plans

- Flex Dollar account allows dollar savings and hedging against naira fluctuations

- Investment options from ₦3,000 with good potential returns

- Referral bonuses provide additional income

- Consolidates finances, savings and investments in one app

Cons on Piggyvest App

- Withdrawal fees on foreign transfers from Flex Dollar

- Limited access to funds in savings plans before maturity

- Reliant on stable internet, which can be an issue in some areas

Piggyvest Vs Cowrywise – Which One is Better?

Piggyvest and Cowrywise are savings and investment apps. Both have emerged as helpful tools for saving and investing money. Piggyvest makes saving money simple and easy for people at all levels of experience.

Its clean design encourages saving without much effort. Cowrywise focuses more on specific savings targets and investment goals. Its layout keeps users focused on what they want to achieve with their money.

Investment Options

Piggyvest is mainly for savings but also has an investment feature called “Investing”. Cowrywise provides more options like mutual funds, bonds and different asset classes. This gives users more control to build balanced investment portfolios based on their preferences and comfort with risk.

Security

Both apps work hard to protect users’ financial information and transactions. They use strong encryption and security protocols to keep money and accounts safe.

Interest Rates on Savings: Piggyvest vs Cowrywise

Savings is an important part of any financial plan, and earning interest on savings allows money to grow over time. Piggyvest and Cowrywise offer interest on deposits. But which one provides a better return?

To compare their interest rates, let’s look at an example. Say ₦600,000 was saved in equal monthly deposits of ₦100,000 over a 6-month period.

On Cowrywise, the total balance after 6 months would be ₦615,319. This means total returns of ₦15,319 or an annual interest rate of around 2.55%.

On Piggyvest, saving the same ₦600,000 total would result in a balance of ₦630,000. The total interest earned is ₦30,000, which translates to an annual interest rate of 5%.

So based on this scenario, Piggyvest offers a significantly higher rate of return on savings deposits compared to Cowrywise. The extra 2.45% per annum can make a big difference in the long run due to compounding.

Of course, interest rates may fluctuate depending on market conditions. But this example suggests Piggyvest generally provides a more lucrative savings rate for users looking to earn passive income from their deposits. Both remain good options, but Piggyvest appears to have a clear edge when it comes to interest on savings alone. Savers can maximize returns by comparing rates across platforms.

Customer Support

They both offer support by email and social media, but there has been some report of delays from the customer service representatives of both Cowrywise and Piggyvest. Based on our survey, both apps need to work on being very responsive on social media platforms, especially to customers in the comment section.

Rating

Piggyvest app has a rating of 3.7 stars from 42,000 users, while Cowrywise app has a rating of 4.2 stars from 28,000 users on Play Store. On App Store, Piggyvest has a 4.5 stars from 8,400 users, Cowry wise has 4.4 stars from 8,700 users.

Final Thoughts

Based on the information provided, here is my verdict on which savings and investment app is better between Piggyvest and Cowrywise:

Piggyvest app appears to be the better option for pure savings due to its significantly higher interest rates. The example provided shows you can earn over 2% more annual interest on deposits with Piggyvest. This difference will really add up over time.

However, Cowrywise may be preferable for those looking to do more active investment. It offers mutual funds, bonds, and a wider selection of asset classes to construct a balanced portfolio. This gives more flexibility and options than just the “Investing” feature on Piggyvest.

In terms of security and customer support, both apps seem quite similar and take steps to protect users. Although some reports indicate, Cowrywise and Piggyvest could both improve their response times when users have questions.

Overall, if your main goal is passive savings growth, Piggyvest is likely the better pick due to its higher interest rates. But Cowrywise is better suited for active investment strategies since it provides more tools and asset classes to work with. Both are good options, so choosing also depends on your specific financial goals and risk tolerance.