In Nigeria, obtaining an immediate loan can be complicated. It is a job in itself because of the documents that need to be completed before you get a loan. Nobody wants to be in a position where they give loans but don’t get paid back. Therefore, there are standards to be satisfied, documents to complete, and a series of cross-checks.

This is what makes the Zedvance loan app different and one of the best loans in Nigeria. The platform offers loans to people at affordable, fast and easy. Zedvance loan packages offer financial solutions to many Nigerians. While the loan app looks promising, does it offer the best loan services?

We used the Zedvance loan platform to obtain a loan, and we will share a detailed review of the process, interest rate, requirements, and pros and cons of Zedvance.

How to Apply for a Zedvance Loan

Applying for a loan at Zedvance limited is relatively easy and fast. You can access Zedvance Loan via their website, but it is better to download the app to navigate all their benefits and pick the suitable loan easily. We could show you a step-by-step process to apply for a Zedvance loan.

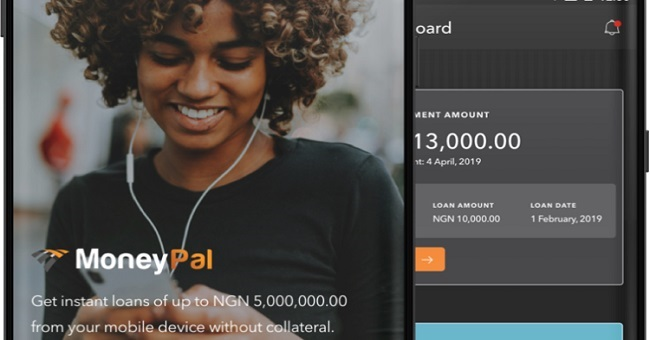

- First, You would need to download the app from the play store or apple store. Use the link below to download. (Zedvance operates as Moneypal on playstore and appstore)

- After downloading the app, you must register. Ensure you provide the correct information. Name, email, BVN, date of birth, and password will all be required during the registration process.

- Once you’ve signed up, you can log in at any time to submit a loan application. Follow the rules, and send in all required paperwork.

- If your request is accepted, you ought to get your loan. Typically, it takes no more than 48 hours.

Requirements for Zedvance Loan Application

Certain things would be required of you to get before you can access a loan at Zedvance loan.

- Utility bills, not more than three months old

- Valid means of identification (Voter’s card, National Identification card. International passport, or driver’s license)

- Passport Photographs

- Employment identification card

- Official email

- Employment letter

- Six months’ bank statement

How much can you get?

You have access to up to 5,000,000. With all things being considered, the amount you are provided will depend on the team and your loan purpose.

Zedvance Loan Calculator

Zedvance’s loan calculator is a valuable tool for planning your finances. By inputting the desired loan amount and preferred repayment period, you can instantly calculate your monthly payments and total interest.

This user-friendly feature empowers individuals to make informed decisions about their financial commitments, ensuring transparency and ease of use.

Zedvance Interest Rate

A 5% to 20% loan rate range is offered. Typically, the business bases loan repayment decisions on risk-based pricing. Check the app loan calculator to find out how much you will have to repay.

How to Repay the Loan

A loan is simple to repay. You have two payment options: checks or a direct debit mandate. You can deposit money into their account if you want to avoid paying with checks. For an account number to pay into, you can get in touch with them. But make sure to get in touch with them 78 hours or more beforehand.

You won’t be able to pay in instalments. When applying for a loan, you can choose how long you wish to make payments. Following that, it is possible to alter the payment date. They may need to be contacted. But there might be fees.

The fine for missing a payment is 1% of the total instalment for each day it is late. More severe actions might be used, and the default would also be reported to the credit bureaus if it goes on for longer than 30 days.

Zedvance Interest Rate

The interest rate varies from 5% to 20%. Generally, the company uses risk-based pricing to determine repayment on loans. You can use the loan calculator on the website to know how much you will have to pay back.

Pros

The loans can be of high capacity. Meaning you could get a very substantial amount from them. It would take a lot to get a high loan from any other credit facility, but with Zedvance, it’s much more manageable.

They boast of a quick loan approval process, faster than usual. This means you can get your loan practically as soon as needed.

Cons

Zedvance operations nationwide are limited. It only operates in Lagos presently, so any applicants and their applications from outside the state are as good as void.

There is too much paperwork involved. It requires a hefty amount of paperwork to fill out and complete in the application process, and at some point, it can get frustrating.

It requires proof of employment and if you’re self-employed or a freelancer, that might prove challenging to present.

Zedvance Customer Care

To contact Zedvance customer care, you can:

- Fill out the “Contact Us” form on their website with your name, email, subject, and description.

- Call them at 0700 100 1000.

- Zedvance Whatsapp Number: 0909 501 7151

- Email them at [email protected].

- Engage with them through their online channels such as MoneyPal by Zedvance and Zedvance Online.

Is Zedvance a Scam?

No. There is nothing to be concerned about with the loan; everything is perfect. These loans are offered by the business Zedvance Finance Limited. It has been in existence for a while now and has been providing Nigerians with reasonable financial solutions and has helped many companies start up or keep up their business.

Conclusion

In conclusion, Zedvance Finance offers a wide range of loan services that are easy to access, flexible, and have easy repayment terms. With Zedvance, you no longer need to worry about collateral or high-interest rates.

They provide a safe and secure platform for all Nigerians to access financial solutions. Their loan packages are tailored to suit the needs of different individuals and businesses. If you need a loan from Zedvance, read this detailed review and go through their terms and conditions before obtaining a loan.